Apart from the COVID-19 pandemic being one of the biggest health crises, it has also shifted consumer habits. As consumers have chopped and changed their old habits with new, businesses have wondered whether these changes would be fleeting or permanent...

Before the outbreak of COVID-19, consumers were already shifting toward a digital and cashless society. The pandemic has amplified it dramatically – according to UK Finance, in 2020, only 17% of all payments were made in cash. Shocking right? However, this might have something to do with the fact that around 54% of small businesses are avoiding handling physical money altogether and a Which? study in November 2020 revealed that 42% of shoppers told them that they were using less cash because they thought card payments were safer.

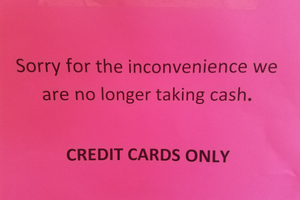

The study revealed that a third of people have had cash payments refused throughout the pandemic. For example, 28% of people for groceries and 24% for leisure activities (such as going to a pub or restaurant). More than three-quarters of respondents who were refused cash payments said it had an emotional impact on them, making them feel frustrated, anxious, or embarrassed. Having clear signage is an obvious way to eliminate miscommunication and prevent negative word-of-mouth that could tarnish your brand's reputation and lose customer trust almost instantly!

Although the government had advised using contactless payments when shopping in-store to prevent the risk of spreading the virus, there are so many other factors reducing the need to keep cash on hand, for example:

- Ease and convenience of not carrying or handling cash

- eCommerce and Social Media shopping is happening much more frequently

- Paying with mobile phones via Apple Pay is becoming increasingly more popular

- A rise of 'buy now, pay later' services that are aiding in cashless purchases such as Klarna

- A new digital way to monitor cash expenditure via online banking apps

With local bank branches closing, free cash machines significantly falling (by around 50%), and 74% of customers planning to be cashless from now on, some people believe cash will become unnecessary. New data from payments giant Worldpay and FIS suggests that just 7% of all purchases in the UK will be via cash in three years. Also, physical money will be almost abandoned in the UK by 2024 as the pandemic saw the use of physical currency drop. Therefore, being a card-friendly business and having up-to-date technology will help you move forward.

When contactless cards first became a thing, there was a limit of £30, which the public thought was ridiculous. The limit is set now to £100 (with the option to change via your online banking app), showing how people have adjusted to something new and realised that they love it. The ability to purchase without tapping in a PIN or simply paying via a mobile phone has become too easy. For example, a recent study from Buymobiles identified that 80% of the public have at least one of their cards stored electronically on their mobile phone and that even older generations are more comfortable with cashless payments. Buymobiles Jess Canning has said, “I don’t think anyone would have predicted that around 2/3 of 60 to 70-year-olds would prefer cashless methods.”

This is something that would never have happened pre-pandemic.

However, every coin has two sides…

Despite the world being heavily focused on cashless and contactless payments there are still around 10 million people who are still not fully prepared – or able – to give up on cash. Alongside that, there are an additional 22 million who say that cash is an essential backup for them; for paying for car parks or buying a cup of coffee. If every business / service refused to take cash, it could end up leaving people with no option and, ultimately, excluding that percentage of people who would have made a purchase previously.

Cash is still vital to so many people, says Nick Quin, head of financial inclusion at cash machine network Link.

If you can give customers more ways to make payments, it also gives you more ways to operate – accepting cash and card payments means flexibility for yourself and your customers. New and old.

We have delivered award-winning research solutions that go deeper than surface opinions for more than a decade. Our solutions reveal what drives brand relationships, makes advertising work, and motivates people to act. Find out what your customers want and see how our tool can help you today.